What is Active or Tactical money management?

Until recently, this strategy has only been available to the extraordinarily rich. But with the continuing improvements in technology, all that’s changed.

To understand what active or tactical money management is, you must understand what it’s not. It’s not Buy and Hold.

What Is Buy and Hold?

A strategy for investors to manage risk by allocating investments among a broad array of asset classes and holding such assets for an extended period regardless of market conditions.

What is Active Investment Management?

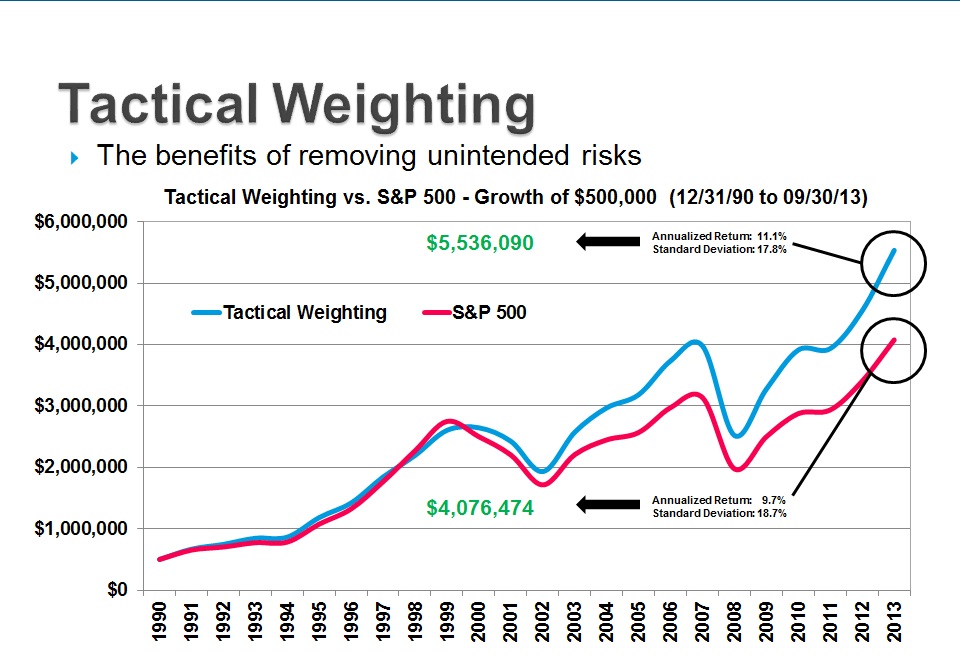

Contrary to Buy and Hold, the portfolio holdings are adjusted on a continuing basis in response to market and economic conditions The active money management strategy is simple but powerful. Active money managers aim to capture most of the market’s good times and miss most of its troubled times. They believe that missing severe market drops is essential to long-term investment success, because the less investors lose during downturns, the less they must make going forward. Active money managers specialize in risk reduction investment strategies. Their goal is to generate solid returns by reducing the perils of volatility by using an Active approach to managing money versus a Passive or Buy and Hold Approach. Active money managers only work with investment advisors, so you will need to work with your advisor if you are interested in this concept.